Reduce Your Insurance Costs with a Construction Risk Management Solution

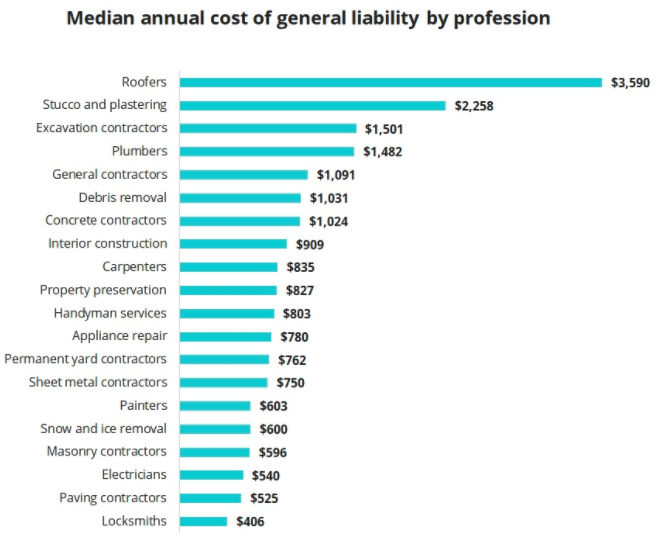

Construction and building companies are some of the most high-risk and expensive businesses to insure—paying more than most.

Table of Contents

Contractors can mitigate this risk with a construction risk management solution.

Construction companies must ensure their operations are safe, healthy, efficient, and protected. Since the risk of accidents is higher due to workers using heavy machinery, hazardous materials, and other risks, construction businesses must ensure they are fully covered by insurance while managing the costs. If not properly managed, your insurance costs could spiral out of control.

Tech to the rescue?

Although a good insurance plan can help protect you in the event of a mishap or dispute, subcontractors can benefit from using software to add an extra layer of protection while controlling insurance costs. It can help you track job activity, capture and manage data, and measure risks. Software also supports effective communication among the construction crew to minimize accidents, leading to fewer construction insurance claims.

But is tech really the answer? Let’s look at the details in the benefits.

Benefits of a Risk Management Solution

1. Reduce claims against lost time and wages

Wage disputes are among the most common types of claims filed by employees against their employers.

Traditional paper check-in processes pose a higher risk of human error and miscommunication. If workers haven’t properly clocked in, this could result in missed time for which they should be compensated. Manual time tracking methods also increase the likelihood of inaccurate time tracking regarding breaks.

Software makes it easy to precisely track the hours that employees work on-site. Managers can ensure everyone is paid correctly and paycheck disputes are minimized.

In the case of a safety incident, there can be controversy about lost wages and lost time for the workers involved. For example, if the project is stalled by inclement weather or a natural disaster, accurate documentation is required to file the insurance claim and keep all stakeholders informed. Insufficient records can mean the difference between having your insurance cover the losses…or not. A system that allows access to, and helps you manage, all the project information can prove invaluable in reducing lost time and wage claims.

2. Improve safety program effectiveness

Taking a risk management solution approach means workers can complete tasks more safely. Companies can also better manage their safety-related costs. Proper staffing of employees and monitoring potential site hazards increases safety for everyone involved. If an insurance company deems your project a high risk, your insurance premium will be higher. Implementing a strong safety program can significantly contribute to reducing your insurance costs.

Safety is inherent to the construction industry. Your entire crew must be informed of safety procedures and issues throughout the project. Regularly schedule safety meetings and keep them up-to-date via weekly safety newsletters, memos, or reports.

Make sure toolbox talks are documented and those records are organized. Create a sense of accountability within your team by designing an incident reporting process. Also, make sure any noted hazards are immediately addressed.

For example, if any unsafe conditions are noticed during daily observations (e.g., proper safety gear not being worn or insufficient safety barriers), these should be reported to the foreperson so the hazard is promptly addressed. Diligence in this regard increases the effectiveness of your safety program while instilling safety into your company culture.

3. Track injuries

In the high injury environment of the construction industry, it’s essential that companies have an accurate injury reporting process to save on insurance costs.

Using technology to report and track injuries can reduce the time spent filing insurance paperwork. A good digital documentation solution can automatically alert HR and streamline the insurance claim by providing easy access to accurate supporting documents.

Tracking injuries allows you to create a stronger safety program, which can reduce incidents and lead to lower insurance premiums.

4. Increase COVID compliance

We’re seeing tighter safety precautions in the industry due to COVID-19—and insurance companies want to see that you have implemented the proper controls across your sites. Proper documentation is key: field supervisors should be taking pictures, filling out checklists, and writing detailed reports.

Make sure you have a COVID-19 specific action plan in place—including contact tracing—and that your entire team is following it. Improving your COVID compliance may mean investing in additional safety gear, as well as training and a pre-screening health questionnaire protocol. Insurers want to know that you’re taking all the necessary precautions.

So, can technology reduce insurance costs? In many cases, yes.

Construction companies can save on insurance costs by using drones to capture footage and create 3D models of job sites, allowing for a better understanding of risks and potential losses. GPS tracking can help manage workers’ movements and ensure they’re adhering to safety protocols. Smart sensors can detect hazardous materials, moisture, and other environmental dangers.

Moreover, construction management software can help supervisors and workers stay on top of managing documentation to prevent, if not minimize, construction claims. Relying on the old paper trail can be time-consuming, produce errors, and create more problems than it solves. Mitigating potential insurance risks via accurate record-keeping reduces your insurance costs.

How Technology Goes Beyond Just Reducing Insurance Costs

Insurance premiums and claims can eat up your budget if you’re not careful. Managers must look for ways to avoid claims and lower premiums to keep costs at bay. eSUB provides a tech solution specifically designed for subcontractors to help them manage documentation, track field workers, activity, and provide hard and transparent evidence in case of an insurance claim.

eSUB’s cloud-based project management platform is a risk management solution specifically designed for subcontractors so they can centralize and manage their data and documentation, and preventing claims. By standardizing processes and documents, eSUB makes document management more efficient, improves quality assurance and control, ensures your project is within scope and budget, as well as accurate and timely report submission. Our platform is user-friendly across devices, including an easy to use interface that keeps the field and office connected and working from the same platform.

If you’re interested in a cloud-based construction risk management solution to improve safety, lower insurance costs, and more, schedule a demo to learn how eSUB can help.

If you found this article helpful, please share it on social media.